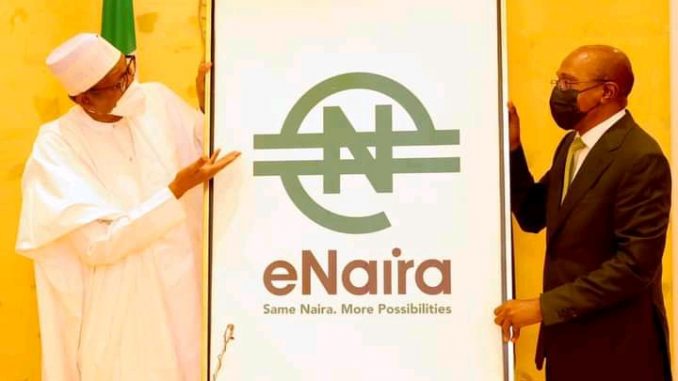

The President Muhammadu Buhari, on Monday, launched the eNaira platform.

The eNaira is a culmination of several years of research work by the Central Bank of Nigeria in advancing the boundaries of payments system in order to make financial transactions easier and seamless for every stratum of society.

The Central Bank Digital Currency (CBDC) eNaira has taken off with over N500m of the currency minted so far.

The Central Bank of Nigeria(CBN) Governor Godwin Emefiele said 33 banks have been fully integrated and live on the platform.

The launch was described by CBN Governor, Godwin Emefiele, as the first in Africa and one of the earliest around the world.

Emefiele said, “Mr President, today you make history, yet again, with the launch of the eNaira – the first in Africa and one of the earliest around the world.

“Mr. President, as you make groundbreaking reforms, there has been continuing debate on the true value of the Naira.

“Rather than worry today on the direction of the exchange rate, let us take a step back and analyse how we got here in the first place.”

Speaking at the launch of the eNaira in Abuja on Monday, Emefiele disclosed that over 2.5 million people visit the website daily.

He said another N200 million has been issued to financial institutions.Over 2,000 customers have been onboarded and 120 merchants have successfully registered on the eNaira platform, Emefiele stated.

Immediately after the launch, Emefiele revealed that “customers who download the eNaira Speed Wallet App will be able to perform the following: onboard and create their wallet; fund their eNaira wallet from their bank account; transfer eNaira from their wallet to another wallet and make payment for purchases at registered merchant locations.”

The CBN, he said, “will continue to refine, fine-tune and upgrade the eNaira” and he assured that “Nigerians should expect to see additional functionalities in the coming months”.

Some of the additional functionalities include: accessibility and onboarding of customers without BVN and the use of the eNaira on the phone without the internet to further drive financial inclusion, making Nigeria one of the first countries in the world to deploy the CBDC via USSD on phones without relying on internet connectivity.

Another feature that will be deployed by the eNaira is the “onboarding of revenue collection agencies to increase and simplify collections and the creation of sector- specific tokens to support the Federal Government’s social programmes and distribution of targeted welfare schemes in a bid to lift millions out of poverty by 2025”.